This ad has already gone. Better luck next time

You may also like

Description:

Many of us are led to believe that you need a solicitor to act for you if you wish to transfer a property to a family member. Moreover, we are also advised that separate solicitors are required to act for each party i.e the transferor and the transferee. The legal costs for paying two sets of solicitors can be very high easily ranging anything between £2000 to £3000 and that is excluding VAT.

However, what most of us don't know is that you do not need a solicitor to transfer property to a loved one where no money is being paid over between the transferor and transferee and where no mortgage is involved. All that is required is actual knowledge of what forms to complete, the land registry fees involved and where to submit your application (coupled with a copy of the land registry official copy register for the property).

So why are we always told that a solicitor is required. Well let's just say that there are legitimate ethical reasons for appointing a solicitor to prevent vulnerable people losing their properties to relatives who could, in extreme cases, take advantage of the old, frail, weak or anyone else who can be categorised as vulnerable due to their particular personal circumstances. Appointing a solicitor ensures that transferring property to a loved one will not result in any such transaction being brought into question at a later date or limits the possibility of a transferor making claim to a fraudulent transaction. Saying that, there are many of us who do not require a solicitor to advise us if we just want to transfer the property to our children, sibling or parent.

There can be numerous reasons for transferring a property to a loved one, a spouse wanting to transfer the whole property to the other spouse where a marriage has broken down for example or a parent wanting to gift a second home to their child or children or where a party is to be added as a named party to the property or someone who's name is to come off as a registered proprietor. The reasons for transferring property to another person or persons are of course endless.

Should you wish to transfer without the need to appoint solicitors you can do so and there is a dedicated Land Registry office which only deals with applications submitted by members of the public. However, it is all about knowing what forms to complete, how to complete them, what information is required to allow you to complete the forms and what fees need to be paid with your application.

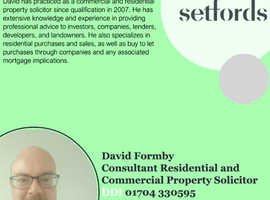

Well, if you want to save on paying two sets of legal fees, I can help with drafting and completing the legal documentation and submitting the application to the land registry for a fixed fee of only £500 which is less than a quarter of the cost of appointing two separate firm of solicitors to deal with the transaction and as I am not VAT registered that is another 20% saving. I have over 25 years legal experience in this field and thus you can be rest assured that your matter will be in safe hands and that you will not be ripped off by firms of solicitors who will charge you a ridiculously high fee to cover their firms high overheads. Moreover, I will be able to do away with the considerable delay in dealing with the transfer of the property usually caused by overworked and heavy workload of solicitors. I endeavour to complete the drafting of the documentation in readiness for submission to land registry within only a few days of receiving your instructions.

Please be advised that no legal advice will be provided as to the merits of the transaction and you may also need to take independent advice from an accountant in respect to any tax implications resulting from you dispensing with your interest in a property. Indeed, solicitors too are mostly unqualified to advise on tax implications and would, in most cases, advise you to seek independent advice from an accountant. The two main tax implications that could arise are usually related to Capital Gains Tax (CGT) or Inheritance Tax (IHT).

Should you wish to utilise my services and save on exorbitant legal fees then let me help you by completing the relevant forms and submitting your application to the land registry. I will further deal with any requisitions raised by the land registry pertaining to the application, if any, and ensure that the application is successfully registered at the land registry.

Why not give me a try. You won't pay me a penny until all documents have been completed and ready for submission to the land registry.

Should you wish to contact me to discuss your proposed transaction, please do so by email leaving your telephone number and I will call you back as promptly as possible.

Kindest regards.

Similar Ads

-

Commercial and Residential Conveyancing Solicitor...

Commercial and Residential Conveyancing Solicitor... -

Asher & Tomar Solicitors:

Asher & Tomar Solicitors: -

Residential & Commercial Conveyancing

Residential & Commercial Conveyancing -

VipMemberAmbassador Bathrooms & Wetrooms

VipMemberAmbassador Bathrooms & Wetrooms -

HOME & COMMERCIAL STAGING + INTERIOR...

HOME & COMMERCIAL STAGING + INTERIOR... -

Gutter clearing (removal of plants and debris to e...

Gutter clearing (removal of plants and debris to e... -

Repairs and maintenance

Repairs and maintenance -

BIM Services in the UK: Pinnacle Infotech...

BIM Services in the UK: Pinnacle Infotech... -

Plastering painting wallpaper removal.

Plastering painting wallpaper removal. -

Handyman services

Handyman services -

Painting and Decorating Services

Painting and Decorating Services -

Premier Experienced RICS Surveyors in Liverpool...

Premier Experienced RICS Surveyors in Liverpool... -

UPVC,ALLUMNIUM AND TIMBER DOORS AND...

UPVC,ALLUMNIUM AND TIMBER DOORS AND... -

Brickwork & plastering

Brickwork & plastering -

Land Managmen. Approved Contractors working with ...

Land Managmen. Approved Contractors working with ...